The Complex Dynamics of Startup Acquisitions: A Case Study

In the rapidly evolving tech landscape, acquisitions are a common strategy for growth and innovation. However, these deals often have varied implications for the different stakeholders involved, including founders, investors, and employees. A recent high-profile acquisition provides a fascinating case study into these dynamics.

Founders and Investors: The Financial Windfall

For founders and investors, acquisitions often represent an opportunity to realize significant financial returns. In this case, the acquisition was structured to provide substantial payouts to the startup’s co-founders and major investors, resulting in returns that exceeded initial expectations. This financial success highlights the potential benefits of strategic partnerships and successful exit strategies for early backers.

Employee Impact: A Tale of Disparity

However, the deal’s structure also revealed a common challenge in acquisitions: the disparity in benefits to employees. While some employees transitioned to the acquiring company with favorable packages, others were left without the anticipated financial gains, leading to dissatisfaction. This underscores the importance of considering employee equity and retention strategies in acquisition negotiations.

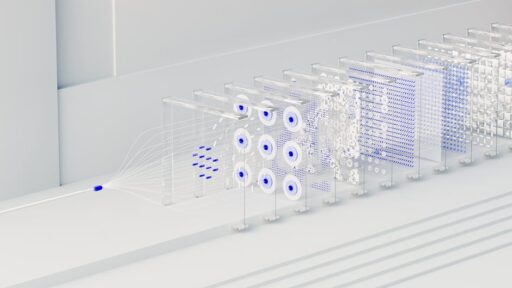

Operational Challenges: Transition and Integration

The acquisition also posed operational challenges, particularly in terms of integrating the acquired company’s assets and talent into the new organizational structure. While some employees embraced the new opportunities, others faced disruptions in their career trajectories. This highlights the need for clear communication and strategic planning during transitions to ensure smooth integration and sustained productivity.

Conclusion: Lessons for Future Deals

This case study serves as a reminder of the complex nature of startup acquisitions. For founders and investors, it emphasizes the importance of strategic foresight and negotiation skills. For employees, it highlights the need for transparency and equity considerations. As the tech industry continues to grow, understanding these dynamics will be crucial for all stakeholders involved in future deals.