Nvidia South Korea AI Partnership: A Strategic GPU Commitment

In a landmark agreement, Nvidia and the South Korean government have announced an expanded collaboration to accelerate the country’s AI ambitions. The deal centers on a large-scale supply of Nvidia GPUs and joint development initiatives across semiconductors, manufacturing, telecommunications, robotics, and autonomous mobility. This partnership signals a decisive move to embed advanced computing into Korea’s industrial backbone and national AI infrastructure.

What does Nvidia’s South Korea AI partnership include?

This question captures the core of the new alliance. At a high level, the partnership includes a commitment of more than 260,000 of Nvidia’s latest GPUs, coordinated investment in AI research and testbeds, and deep collaboration with major Korean technology and manufacturing groups. The program is structured to serve both public-sector AI initiatives and private industry deployments, helping South Korea build an integrated ecosystem for AI development and deployment.

GPU allocation and strategic focus

According to the announcement, the GPU allocation will be split between government-led projects and private industry implementations. Broadly speaking, the program focuses on three pillars:

- National AI infrastructure: public AI centers and shared data facilities for research and public services.

- Industrial transformation: AI-enabled manufacturing, predictive maintenance, digital twins, and robotics for major conglomerates.

- Smart mobility and physical AI: autonomous driving, software-defined vehicles (SDVs), and robotics for logistics and production lines.

How the GPUs will be distributed

Key allocations include:

- ~50,000 GPUs to support public initiatives, including national AI data centers and shared public compute resources.

- Over 200,000 GPUs designated for leading Korean firms—Samsung, SK, Hyundai Motor Group, and Naver—so they can develop industry-specific AI models, scale production-grade AI, and deploy real-time optimization systems.

This distribution is explicitly designed to balance public research needs and rapid industry deployment, enabling Korea to compete at the forefront of AI applications across multiple sectors.

Why does this matter for Korea and the global AI landscape?

The scale and scope of this partnership matter for several reasons:

- Rapid capacity growth: Securing hundreds of thousands of high-performance GPUs accelerates model training, simulation, and inference at a national scale.

- Industry modernization: Integration of AI across manufacturing and mobility can drive productivity gains and reduce time-to-market for new products.

- Strategic sovereignty: National compute resources and domestic AI research reduce dependency on external compute pools and help shape national strategy.

From an industry perspective, the collaboration also strengthens Korea’s role in the global AI supply chain—both as a provider of critical hardware components and a leading deployer of large-scale AI systems. For more on how GPU dominance reshapes markets, see our analysis of Nvidia’s market position in recent years: Nvidia Hits $5 Trillion Market Cap — AI GPU Dominance Grows.

How will major Korean partners deploy Nvidia technology?

Samsung: AI at every stage of manufacturing

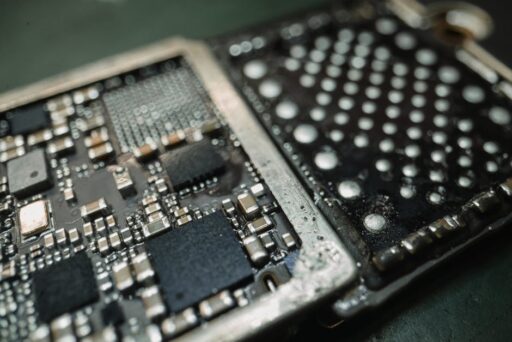

Samsung plans to build an AI-focused mega-factory in partnership with Nvidia. Using tens of thousands of GPUs along with simulation and digital twin platforms, the facility aims to apply AI across semiconductor production, mobile device assembly, and robotics. Real-time analytics and predictive modeling will optimize yield, reduce defects, and accelerate R&D cycles.

Beyond factory operations, Samsung’s collaboration with Nvidia extends to next-generation memory and interfaces designed for AI workloads. These developments aim to ensure that Korea remains a leader in both component technology and AI-enabled manufacturing.

Hyundai Motor Group: Physical AI and intelligent mobility

Hyundai and Nvidia are aligning to accelerate AI-driven advances in mobility, from vehicle design and manufacturing to autonomous driving and robotics. The partnership will focus on large-scale model training and validation, high-performance GPU supply, and the establishment of AI research centers in Korea devoted to physical AI—AI systems that interact directly with hardware and real-world environments.

This alliance targets smart factories, software-defined vehicles (SDVs), and robotics, using integrated compute stacks for training, validation, and deployment to speed development cycles for next-generation mobility solutions.

SK Group and enterprise manufacturing AI cloud

SK Group plans to launch an enterprise-led manufacturing AI cloud leveraging simulation, digital twin technologies, and shared compute resources. This cloud will be accessible to government agencies, public institutions, and startups, enabling broad industry adoption of AI for process optimization, quality control, and supply-chain resilience.

Naver Cloud: Bridging physical and digital worlds

Naver Cloud will work with Nvidia to create platforms that connect real-world industrial sites with powerful cloud-based AI services. Target industries include semiconductors, shipbuilding, energy, and biotechnology. The goal is to accelerate the adoption of AI solutions that are optimized for operational environments and to facilitate rapid prototyping and deployment of domain-specific models.

What technologies and platforms are central to the collaboration?

The partnership pairs Nvidia’s compute architecture and software stack—spanning GPUs, simulation platforms, and digital twins—with Korea’s industrial know-how. Key technology components include:

- High-performance GPUs for large-scale model training and inference.

- Simulation and Omniverse-style digital twins to model and optimize manufacturing and logistics.

- Next-generation memory and interconnects designed for data-intensive AI workloads.

- AI-RAN research to combine mobile networks with AI for improved performance and efficiency across telecom infrastructure.

This alignment of hardware, software, and domain expertise creates an environment where AI can be embedded across the value chain—from chip design to finished products and services.

What are the national and industrial implications?

Beyond corporate gains, the Nvidia–Korea partnership has broader implications:

- National competitiveness: Korea’s investment in domestic AI compute capacity positions it for leadership in AI-driven industries.

- Workforce and research: New research centers and industry collaborations will spur talent development and interdisciplinary R&D.

- Policy and infrastructure: Large-scale public AI centers and testbeds will inform regulatory frameworks and public service deployments.

For context on broader infrastructure and investment trends shaping these developments, see our deep dive on global AI infrastructure efforts: The Race to Build AI Infrastructure, and for how memory and contextual systems are evolving to support LLMs and apps, read: AI Memory Systems: The Next Frontier for LLMs and Apps.

How will this affect companies, startups, and researchers?

Access to large-scale compute and collaboration with hyperscale partners lowers the barrier to building and deploying advanced AI models. Expected benefits include:

- Faster model iteration and time-to-market for enterprise AI solutions.

- More specialized, industry-specific models trained on domestic datasets and optimized for local conditions.

- Expanded opportunities for startups to prototype on public testbeds and access enterprise-grade infrastructure.

These outcomes should stimulate an ecosystem where applied research translates more quickly into production systems across healthcare, manufacturing, energy, and mobility.

What are the risks and considerations?

While the partnership offers clear opportunity, it also raises questions that stakeholders must manage carefully:

- Supply chain concentration: Heavy reliance on a dominant GPU supplier concentrates risk and bargaining power.

- Data governance: Scaling national AI centers requires clear frameworks for data privacy, security, and ethical use.

- Workforce transitions: Rapid automation and AI integration create both opportunity and disruption for workers—requiring robust retraining programs.

What comes next?

Implementation will proceed across research, public infrastructure, and industry pilots. Key near-term milestones to watch include the rollout of national AI data centers, the operationalization of Samsung’s AI-enabled factory projects, and the establishment of Hyundai’s AI research centers for physical AI. Over the medium term, expect joint testbeds for AI-RAN, advanced memory collaborations, and the emergence of industry-specific model marketplaces that leverage domestic compute capacity.

Takeaways

- The Nvidia South Korea AI partnership is a major, coordinated investment in compute and AI capability—over 260,000 GPUs will anchor both national and industry deployments.

- Partnerships with Samsung, Hyundai, SK, and Naver span manufacturing, mobility, cloud services, and telecommunications—creating a wide-ranging industrial AI ecosystem.

- Strategic benefits include accelerated AI adoption, expanded R&D, and strengthened national competitiveness, but they come with governance and supply-chain considerations.

Want to stay updated?

Subscribe to Artificial Intel News for ongoing coverage of AI infrastructure, industrial deployments, and strategic partnerships shaping the future of intelligent systems. Dive deeper into how industry leaders are aligning hardware and software to scale AI across sectors—follow our analysis and reports for practical insights and expert perspectives.

Call to action: Read our latest investigations and subscribe for alerts on further developments in this story and related AI infrastructure trends.